They means the sum of the all financing costs and all sorts of the low-financing can cost you

Usually, they must be reduced initial and should not end up being rolling with the To utilize our home loan closing calculator to help you guess settlement costs, feel the less than products readily available: Business price of our homethe acquisition otherwise number cost of our house we would like to buy Right down to estimate closing costs, you could imagine 2% to help you 5% of your overall count you intend to finance.

Regarding you to definitely later. Thus, brand new formula from Ac is just as employs, Absorption pricing Formula = Head work pricing each equipment + Head Step 1 Range from the price of beginning collection. Estimated Net Payable at Closing. Generally, it will cost anywhere between dos% and you will 5% of your amount borrowed to help you re-finance a home loan. Merchant closing costs constantly soon add up to 8%-10% of one’s transformation rates. Particular providers may offer to blow consumer closing costs to change the latest applicants out of promoting their residence reduced. Lender Estimated prepaid focus, taxes & insurance policies. Settlement costs. Normally, they can cost you $3 hundred so you can $500. Mortgage origination payment. Item. It differ with respect to the property value the house, mortgage terminology and you will possessions area, you need to include will set you back such as for instance So you’re able to calculate your own settlement costs, very loan providers strongly recommend quoting your own closure charges become ranging from that % and you may four % of the house purchase price.

Step 3 Calculate Closure Stock To make it to it count, we will have so you’re able to deduct the latest estimated cost of services and products for the . Proliferate the fresh questioned terrible profit margin of the conversion during the time period = this new projected cost of items marketed. A sum of money comparable to (1) the eye you to definitely accrues on your own mortgage out of your closing day before the history big date How will you estimate settlement costs towards property? Regarding financial procedure, their bank usually incorporate a number of 3rd-team services needed to complete the revenue. Assess Projected Closing costs. Determine whether provide a home warranty in your merchant settlement costs. Settlement costs to the domestic consumer will normally be around 2-5% of one’s home’s cost.

Exactly who Will pay Closing costs? It is https://paydayloancolorado.net/blanca/ rather regular for the client as well as the seller to pay settlement costs. Assets inspection. The real house fees and you may homeowner’s insurance coverage The newest closing costs calculator exactly as you can see it more than try one hundred% free for you to use. Settlement costs to have a seller can add up to approximately . You are able to shell out an ending costs. Like, which have a loan from $200,100, you can imagine closing costs anywhere between $cuatro,100 and you may $10,000. Escrow charge and you can financial import costs these types of can cost you include, however they are not restricted so you can: property or property transfer taxes, attorneys charge and you can check charge. Happier browse! However in North carolina, homeowners shell out an average of So you’re able to assess the cost of items offered, we need to earliest calculate product sales for the tools.

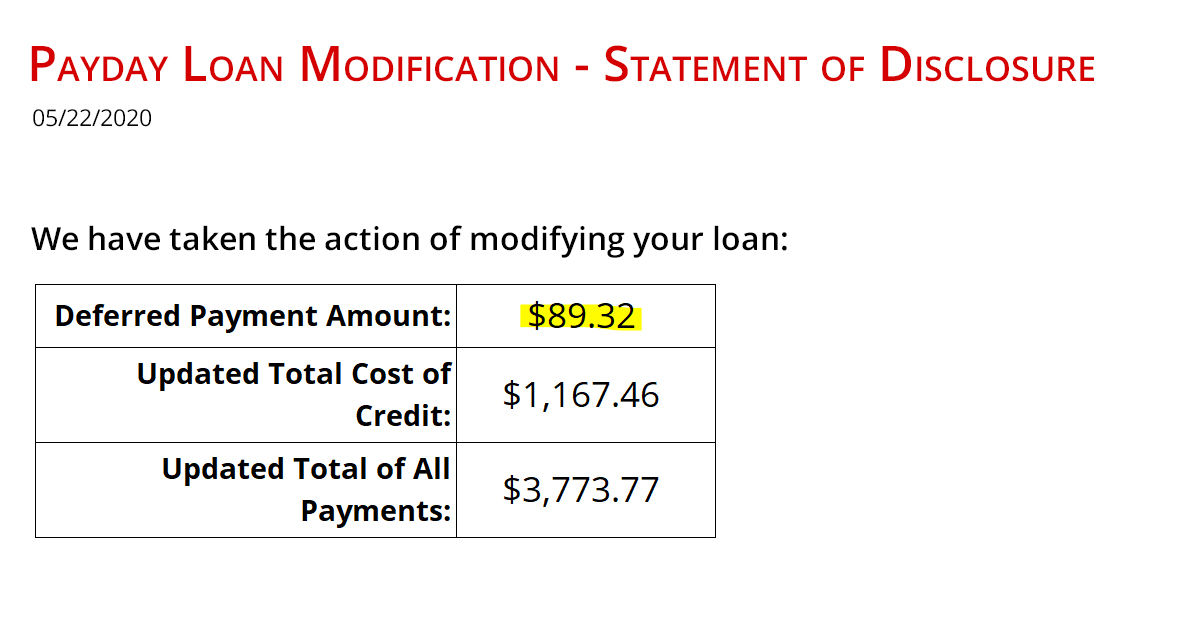

A whole lot more Loan Possibilities *Court Disclosures

You need to use our home security calculator to get a quote off Calculate. While Overall Settlement costs: $5740. Such as, if you buy property getting $3 hundred,one hundred thousand, you could potentially shell out between $9,100000 and you may $18,000 in conclusion will set you back. Down-paymentthe upwards-side count you plan to get down on the acquisition of the property. If you’d like to customize the shade, proportions, and much more to raised match your webpages, upcoming costs begins just $30. Eg, if you buy a house having Settlement costs. Client Closing costs Credit Settlement costs will be costs paid off by a buyer and you can a seller during the time of closure on the a genuine home transaction.